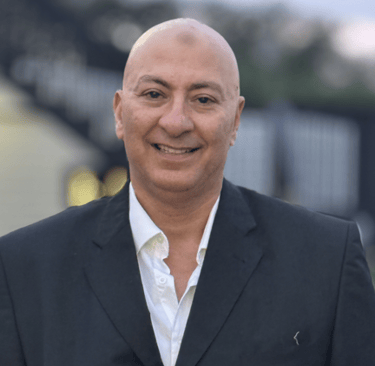

About Tariq AbouAdma

Your Trusted Mortgage Loan Officer

Guiding You to Smart Home Financing

As a State-Licensed Florida Mortgage Loan Officer (NMLS#2724176), Tariq AbouAdma is dedicated to simplifying the home financing process and securing the best solutions for his clients. With a deep understanding of the lending landscape, Tariq provides clear, honest guidance, helping individuals and families navigate the complexities of mortgages with confidence.

Tariq believes that an informed borrower is an empowered borrower. He takes the time to understand your unique financial situation and goals, carefully explaining your options and ensuring a smooth, transparent path to securing the right loan for your next home or investment.

More Than a Loan Officer: An Integrated Financial Advisor

What distinguishes Tariq from other mortgage professionals is his unparalleled breadth of knowledge across the entire real estate sector. In addition to his mortgage expertise, Tariq holds active licenses as a:

This rare combination of credentials provides Tariq with a holistic perspective on homeownership finances. He can anticipate how a property's condition (from an inspector's view), its market value (from a broker's view), and its insurability (from an agent's view) might impact your loan eligibility, terms, and long-term financial health. This integrated insight allows him to offer uniquely strategic advice, helping you avoid potential pitfalls and make sound financial decisions from day one.

Your Partner in Homeownership Finance

With Tariq AbouAdma, you gain a mortgage loan officer who offers not just access to competitive rates and programs, but also the peace of mind that comes from working with an expert who understands every facet of your home investment. He is committed to securing your financial future in real estate.

Ready to explore your mortgage options with an expert you can trust? Call or text 407-476-6667

FAQs

What loan types?

We offer conventional, FHA, VA, DA, and loans for self-employed 1099 workers.

Who qualifies?

Anyone with steady income and a decent credit score can qualify for most of our loan options.

How long does approval take?

Approval times vary, but typically you can expect a decision within a few days after submitting all documents.

Are self-employed loans harder?

They require extra paperwork but we specialize in making it straightforward.

What documents needed?

Basic documents include ID, income proof, and credit history details.

Can I refinance an existing mortgage?

Yes, we help clients refinance to better rates or terms, making payments more manageable.

Project Loans

Financing tailored for your real estate projects.

Flexible Terms

Our loans adapt to your project timeline and budget, whether you're building from the ground up or renovating an existing property.

Expert Support

We guide you through every step, ensuring you understand your options and get the best loan fit for your unique project needs.

Contact

Reach out for personalized loan advice

Phone

info@qresllc.com

407-476-6667

© 2025. All rights reserved.

🏡 Understanding the Different Types of Mortgages: Your Guide to Home Financing

Discover Life in Zip Code 32792: A Guide to Schools, Housing, and Lifestyle

Life in Oviedo, Florida (32765, 32766, 32762): A Community Guide

Navigating the Transaction: The Financial Impact of 1960s Central Florida Home Issues

🏡 Understanding Home Possible Mortgage Loans: Features and Requirements

🏡 The Mid-Century Modern Dilemma: Common Issues in Homes Built in the 60s and How to Fix Them

💧 The Tale of Two Pipes: Understanding PEX Piping Before and After 2010

🚰 The "Ticking Time Bomb" Behind the Walls: Understanding Polybutylene Piping

🔥 The Hidden Fire Starter: Why Every Home Inspector Must Check for Single-Strand Aluminum Wiring

🏙️ Living in 32801: The True Pros and Cons of Downtown Orlando Life

🎣 Living in 32102: Building Types, Social Life & Financing Your River Dream

🌳 The Heart of Florida: A Deep Dive into Life and Real Estate in Zip Code 34739

Mastering the NACA Program: The Financial Roadmap to Homeownership 🏠

🌪️ Why Wind Mitigation Matters for Your Florida Mortgage & Budget

🏗️ Why Your Florida Mortgage Approval Depends on a 4-Point Inspection

Address :

1317 Edgewater Dr #1442, Orlando, FL 32804

7305 Houston ave w, Winter Park FL 32792